Trump's shell game when it comes to Social Security

President Donald Trump won re-election in a large part because he promised to remove the Federal Tax on Social Security. Instead, he offered a "replacement tax deduction" that only applies to some

By Ray Hanania

FREE/Social Security, Donald Trump, Hakeem Jeffries, Republican and Democrat lies/Friday, July 4, 2025

Many seniors voted for Donald Trump’s second term because he promised to eliminate the Federal tax on Social Security.

Currently, seniors who collect Social Security starting at age 62 must pay taxes on it when it is combined with other work income.

In today’s economy, and because the U.S. Congress has abandoned seniors, most seniors have to continue working after they start receiving Social Security in order to make ends meet and put food on the table.

Seniors are the biggest target of scams mainly because of the impact age has on their reasoning and response time. The older you get, the less you remember or the longer it takes for you to remember.

Trump used that fact to attack President Joe Biden, referring to it as “Bidenitis.”

But apparently, Trump suffers from Bidenitis, too!

Trump forgot his promises to the Seniors. No. He abandoned his promise to Seniors.

Instead of removing the tax on social security this week, Trump pulled a fast shell game. He is giving the poorest seniors who make under $75 a year (including Social Security which ranges annually between $22,000 to $48,000, depending on what age you filed for your social security), the biggest break, up to $6,000, as long as you don’t itemize your deductions and take the standard deduction. There are some breaks for those who itemize, but many itemized deductions have been eliminated under the Trump bill. Click HERE to get more info on the $6,000 deduction.

Remember when you could deduct all your property taxes? Now you are limited to only $10,000, and property taxes continue to rise, especially for the Middle Class.

Click Here to read the text of Trump’s entire bill as adopted by Congress. Click Here to read about the two Republicans who voted against the Trump Bill.

It's a “replacement tax deduction” that replaces the promise to remove the tax on Social Security. You already get $2,000 in a standard deduction – double for seniors filing as a family/couple.

Most seniors in that level are already paying very little taxes because of their low incomes, so the “deduction” has minimal impact, although it touches many seniors.

The majority of seniors who are working and earning upwards of $75,000, including their Social Security wages, will pay taxes. If they are working, they most likely file itemized deductions and won’t benefit from Trump’s “replacement tax deduction.”

Click Here to use the New York Times calculator to see generally how the bill will impact you.

Why did Trump pull this fast one on the seniors? Because he and the Republicans think seniors are stupid.

Trump knows that when you file your taxes next year, you are so old and stupid, you will have forgotten his fake promises.

Meanwhile, Trump claims that he is giving tax breaks to the rest of the American people.

The breaks are very small compared to the breaks he is giving to himself and other super wealthy American business and corporate owners who are the real beneficiaries of Trump’s “Big Beautiful” bill.

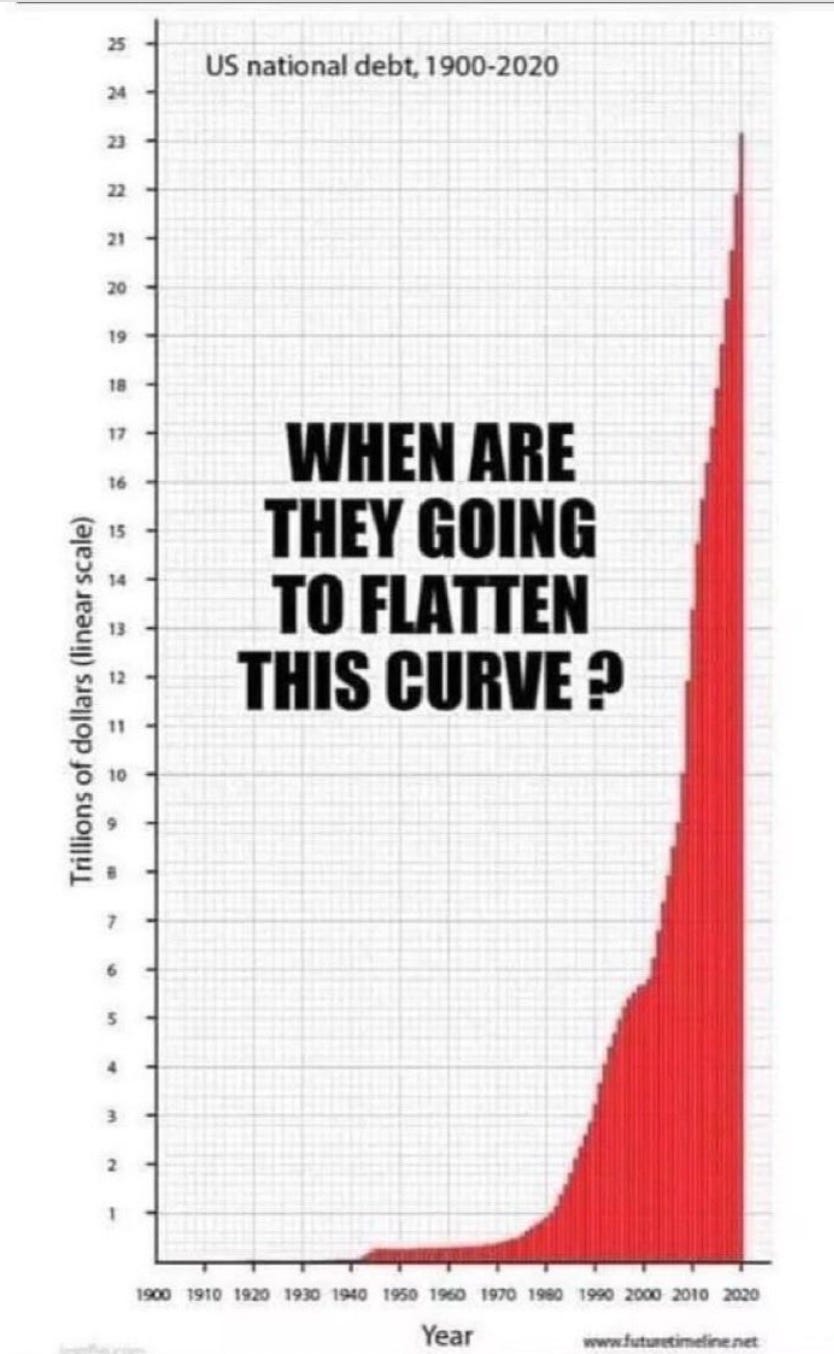

What little tax breaks average families are getting are washed away by rising inflation, which is being driven by the rising National Debt that Trump initiated in 2020 during his final year of his first term in office.

Let’s use a grocery item like eggs as an example. The cost of eggs jumped from $1.50 for a dozen in 2020 to as much as $6.23 cents today.

But Trump has been saying the prices have dropped.

He’s right, they did drop, but not the way you think.

The price of eggs today is between $4 and $7, so that is a slight drop. But they are still 2 and 3 times higher than before.

That’s the problem with Trump and the Republicans. They use the Big Lie to make claims and twist facts. They pander to groups with their lies like to Seniors and even Veterans, because they think seniors are stupid, and ma ny veterans are homeless, poor or suffering from wartime illnesses and PTSD, all things that Trump and most Republicans don’t have to worry about because they didn’t serve in the U.S. Military. They just pander to us!

That doesn’t make the Democrats any better, though. Most Democrats didn’t serve. And when they were in charge before political polarizations froze this country, they did nothing to help seniors.

They lied, too.

Congressman Hakeem Jeffries, the Democratic House Minority Leader from New York City, is the poster child of everything that is wrong with the Democratic Party.

Jeffries supports open borders and foreigners entering the country illegally. He wants to give them benefits without enforcing laws set by the U.S. Constitution.

Worse, Jeffries supports the weakening of punishments for criminals, a cornerstone of the Democratic Party. He’s also a hypocrite when it comes to human rights.

Zohran Mamdani won the Democratic Primary for Mayor of New York City, but Jeffries opposes him because he defeated his pal, the loser Andrew Cuomo. Cuomo and Jeffries believe human rights only apply to certain people of religion and color.

That’s why I am looking favorably towards Elon Musk, who is pushing to create a new political party called “The America Party.” Click Here to see the Musk poll on X.

History of the US National Debt going back to 1900. Musk is right. The debt needs to stop.

NOTES ON THE SOCIAL SECURITY CHANGES:

· President Trump said he would eliminate taxes on Social Security benefits, but the One Big Beautiful Bill (OBBB) stops short of fulfilling that promise.

· The Senate version of the OBBB would help 33.9 million seniors, with an average increase in after-tax income of $670 per person, according to the White House.

· The White House says 88% of seniors on Social Security would pay no taxes on benefits under the Senate bill, an increase from 64% under current law.

· President Trump on several occasions during his recent campaign vowed to end taxes on Social Security benefits. Legislation currently working its way through Congress (i.e., the One, Big, Beautiful Bill Act) is built around his policy priorities, but it stops short of fulfilling that specific promise.

· Nevertheless, there is good news for retirees on Social Security. The version of the One, Big, Beautiful Bill (OBBB) that recently passed the Senate includes provisions that would increase after-tax income for millions of seniors.

· The OBBB passed the House of Representatives by a single vote on May 22, and an amended version slipped through the Senate by an equally narrow margin on July 1. The bill now returns the House, where lawmakers can either approve it or make changes that would require another Senate vote.

· Importantly, while budget reconciliation bills are not permitted to change Social Security, both versions of the OBBB include deductions that would help millions of seniors on Social Security. The recently passed Senate bill includes the following:

Single seniors (aged 65 and older) can deduct $6,000 from taxable income, and married seniors filing jointly can deduct $12,000 as a couple.

The full $6,000 per-person deduction is available to single filers with income up to $75,000 and joint filers with income up to $150,000. Beyond those levels, deductions are phased out.

Importantly, the new senior deductions would be additive with other tax breaks, including the standard deduction and existing senior deductions, as detailed below:

Under current law, the standard deduction is $15,000 for single filers and $30,000 for joint filers. The Senate bill raises the standard deduction to $15,750 for single filers and $31,500 for joint filers.

Under current law, seniors get an additional standard deduction of $2,000 for single filers and $3,200 for joint filers. The Senate bill leaves those existing deductions in place.

The Senate’s version of the “big, beautiful bill,” which passed Tuesday, includes a $6,000 tax deduction for Americans 65 or older.

The provision does not entirely end taxes on Social Security, but it would zero out the Social Security tax burden for 88 percent of seniors, according to an estimate by President Trump’s Council of Economic Advisers.

That’s up from 64 percent of seniors who are currently exempt from Social Security taxes, meaning about 14 million additional seniors will benefit from the change.

The version of Trump’s megabill that squeezed through the Senate would offer a tax deduction of $6,000 to seniors making up to $75,000 individually, or $150,000 on a joint return. The deduction is lowered for incomes above that level, and phased out altogether for seniors with individual incomes of more than $175,000, or $250,000 jointly.

Seniors can currently claim a standard deduction of $15,000 (or $30,000 for couples), plus an additional senior-specific deduction of $2,000 (or $3,600 for couples). The Senate bill would also raise the standard deduction by a few hundred dollars.

The median income for seniors in 2022 was about $30,000.

The new legislation is expected to provide limited benefits for lower-income seniors because they already pay less in taxes.

“While it may be pitched as going to low-income seniors, low-income seniors don’t pay taxes already,” Marc Goldwein of the Committee for a Responsible Federal Budget (CRFB) told The Washington Post.

Goldwein said the new deduction would be more meaningful for upper-middle-class seniors.

The new senior deduction also has implications for the federal fund that pays out Social Security benefits, which was already facing insolvency in the coming decade: Along with other changes to the program, the deduction could speed up the exhaustion of the Social Security trust fund by about a year, the CRFB estimated last week.

The Senate version, which is currently set to expire after 2028, could cost $91 billion over four years, according to the CRFB. The House version of the tax bill would set the new senior deduction at $4,000, a $66 billion cost over four years.

Democrats and independent analyses said the Senate bill will add at least $3.3 trillion to the federal deficit. The White House said the bill will reduce the deficit by $1.4 trillion. They differ over whether to count an extension of expiring tax cuts as new spending.

Democrats call the bill “tax breaks for billionaires” while Republicans frame it as a tax cut for “working-and-middle class Americans.” Independent analyses indicate that on average, taxpayers in each income group would see some tax relief, though those with the highest incomes would derive the most benefit.

Trump says if the bill passes there would be “no tax on Social Security.” Not exactly. Under the House and Senate versions of the plan, fewer seniors would pay taxes on Social Security benefits, but millions of Americans would still have to pay.

In a Fox News interview on June 29, Trump again claimed — as he has repeatedly — that if the bill passes there would be “no tax on Social Security.” Not exactly. Under the House and Senate versions of the plan, fewer seniors would pay taxes on Social Security benefits, but not everyone would be exempt.

The version of the bill passed by the Senate would add a $6,000 tax deduction for seniors age 65 and older ($12,000 for married seniors) beginning in 2025 and through 2028 — regardless of whether they receive Social Security benefits. (See Sec. 70103) The House version of the bill proposes a $4,000 deduction for seniors though 2028. (See Sec. 110103)

According to the White House’s Council of Economic Advisers, 64% of seniors aged 65 and over who receive Social Security income already receive exemptions and deductions that exceed their taxable Social Security income. So, already, most seniors do not pay taxes on their Social Security income.

Under the more generous Senate version of the bill, an additional 14.2 million would have exemptions and deductions exceeding their taxable Social Security income, so that, in effect, 88% of seniors would not pay any taxes on their Social Security income, according to CEA. The senior deduction would start to decline for individuals with incomes of more than $75,000 and couples with incomes of more than $150,000, and would disappear entirely for individuals making over $175,000.

So, the Senate version of the bill would dramatically reduce the number of seniors who pay taxes on Social Security benefits. But it wouldn’t eliminate taxes on Social Security entirely. According to the CEA’s own analysis, more than 7 million seniors with higher incomes would still pay taxes on Social Security benefits.

From the White House

A senior who files as a single taxpayer and receives the current average retirement benefit (approx. $24,000) will see deductions that exceed their taxable Social Security income.

Married seniors who both receive the average $24,000 Social Security income — a total of $48,000 in annual income — will also see deductions that exceed their taxable Social Security income.

Trump Tax Reform Proposal (Potential Changes for 2025-2028): There's a proposal for a new "bonus" senior deduction in addition to the current extra standard deduction.

This "bonus" could be $4,000 (House bill) or $6,000 (Senate bill) per individual.

It would be available to both standard deduction and itemizing filers.

It would be phased out based on modified adjusted gross income (MAGI).

Single filers: Deduction phases out when MAGI exceeds $75,000.

Joint filers: Deduction phases out when MAGI exceeds $150,000.

This proposal is temporary (2025-2028) and subject to change based on final legislation.

This only applies to seniors (family) earning under $150,000 a year meaning the lower your income the more you can deduct. If you earn $48,000 you can deduct $12,000.

The "Big Beautiful Bill" is a hodgepodge of misleading information with spotty benefits for the Middle Class, Trump's base, but many benefits for the wealthy, Trump's true priority. Trump has in the past and now cut benefits to the Middle Class homeowners, including the punitive limitations he placed on property tax deductons.

Clearly, Biden and Harris would have been no different. They would have done more for the lowest economic class, which they think empowers their voter base because they take the rest of their voters for granted. The Democrats who fell into their shoes are even worse.

Another great article, Ray! I always learn something about our country from your writings. Keep up the great work! Personally, I'm not impressed with Elon Musk politically. DOGE was/is a disaster for privacy protections and the layoffs appear to be totally arbitrary and completely inefficient, exactly the opposite of what Trump/ Musk promised. Through Musk's association with Trump and DOGE, Musk damaged his brand and the brands of both SpaceX and Tesla. I find myself agreeing with you about political parties needing to prioritize Middle America and cut foreign military aid "disguised" as diplomacy. I'm just not sure Musk is trustworthy enough to supply the answers needed. It's a privilege to read your articles. They are ALWAYS thoughtful, well-written and thought provoking. You help me keep an open mind. Thanks again and Happy July 4th!