Pritzker pushes Stratton for Durbin seat for selfish reasons

Everything J.B. Pritzker does is designed to enhance his selfish agenda and advance his own career. He bought the governor's office using his endless, unearned wealth. He only cares about himself.

By Ray Hanania

FREE/Politics, US Senate, Dick Durbin/Friday April 25, 2025

It seems like anyone can be elected to public office these days without having to earn it or offer good ideas to serve the public interests.

This week, U.S. Senator Dick Durbin announced he will not seek re-election. It didn’t take long for many politicians who currently hold public office to announce they plan to run for that office.

But before voters line up behind the “favorites” and the “celebrities,” they should take time to review the records of the candidates who want to succeed Durbin, and not be pushed into supporting choices based on the personalities of those who are pushing them.

There are some candidates who are very qualified to be Senator and to hold public office. They include Illinois Treasurer Michael Frerichs. Illinois Comptroller Susana Mendoza. Illinois Attorney General Kwame Raoul. Congresswoman Robin Kelly. State Senator Michael Hastings. Cook County Treasurer Maria Pappas. They all have strong records and commitments to the interests of the taxpayers.

But for others, money is going to cloud the issue of qualifications and great ideas. The biggest source of election campaign money pollution is our Governor, J.B. Pritzker.

Pritzker is pushing his Lieutenant Governor, Juliana Stratton, to succeed Durbin in the U.S. Senate. And he will put the weight of his money behind her.

First, let me ask you this. What is the first thing that comes to mind when you think of Juliana Stratton?

[Cricket sounds in silence]

My answer? She may be a nice person, but as a politician, she is little more than a lackey for Gov. J.B. Pritzker’s selfish political ambitions.

If Stratton wants to win voter support, she has to distance herself from Pritzker’s money and his failed record as a governor. While Stratton is a nice person, she has done little of significance to advance the interests of the people of Illinois.

Instead of being a voice to champion the rights of Illinois residents, she has been a mouthpiece for Pritzker’s failed policies. Many Democratic Party leaders were quick to endorse Stratton because they are benefiting from Pritzker’s dole. Yes. Money matters to some politicians more than the interests of the citizens.

Being Pritzker’s running mate makes Stratton the worst choice to succeed Durbin. And it is very unlikely that Stratton will turn on the wealthy insider who put her in office, giving Pritzker’s image this false sense that he cares about the concerns of minorities and women.

Stratton’s worst qualification is the fact that she is Pritzker’s running mate. The fact that anyone supports Pritzker should disqualify them from running for any public office.

Pritzker, who ran and won for Governor twice, used his huge family wealth to buy his way into the Governor’s mansion in Springfield. While Pritzker promised many things during his campaign, he delivered on very little. He wasn’t elected because of his great ideas or his track record serving the people. He was elected because voters were pounded with exaggerated claims in dozens and dozens of mailers, TV commercials, and radio ads. Voters were under a Pritzker political blitzkrieg!

Pritzker spent more than $323 million to buy the governor’s office in both elections. No one could come even close.

It is one of the defects in American elections. The wealthier the candidate and the more money they can spend on themselves, the better their chances to win office. Combined with never having done anything of significance before they ran makes it even easier to win. It’s hard to criticize someone who doesn’t have a record of achievement, and therefore, they have no “baggage.”

That’s Pritzker. The spoiled brat from a wealthy family who did nothing of significance, but can spend an endless amount of money to convince the public he has.

Is that what you want in government? Pritzker is Stratton’s albatross.

When Pritzker first assumed office in 2019, Illinois ranked among the worst states when it came to public services, and it continued to have the worst and most repressive taxes. It’s gotten worse.

The most recent tax Pritzker is planning to implement is a 30-cent per mile tax on motorists. Why? Because the growing popularity of Electric Vehicles is fast replacing gas-guzzling vehicles. Gas is heavily taxed in Illinois, and Illinois gas tax revenue collections are lagging.

Pritzker’s solution? Find another way to make taxpayers pay, rather than improve the state system to maintain roads, reduce the excessive contract costs paid to the Unions, and make Illinois government more efficient.

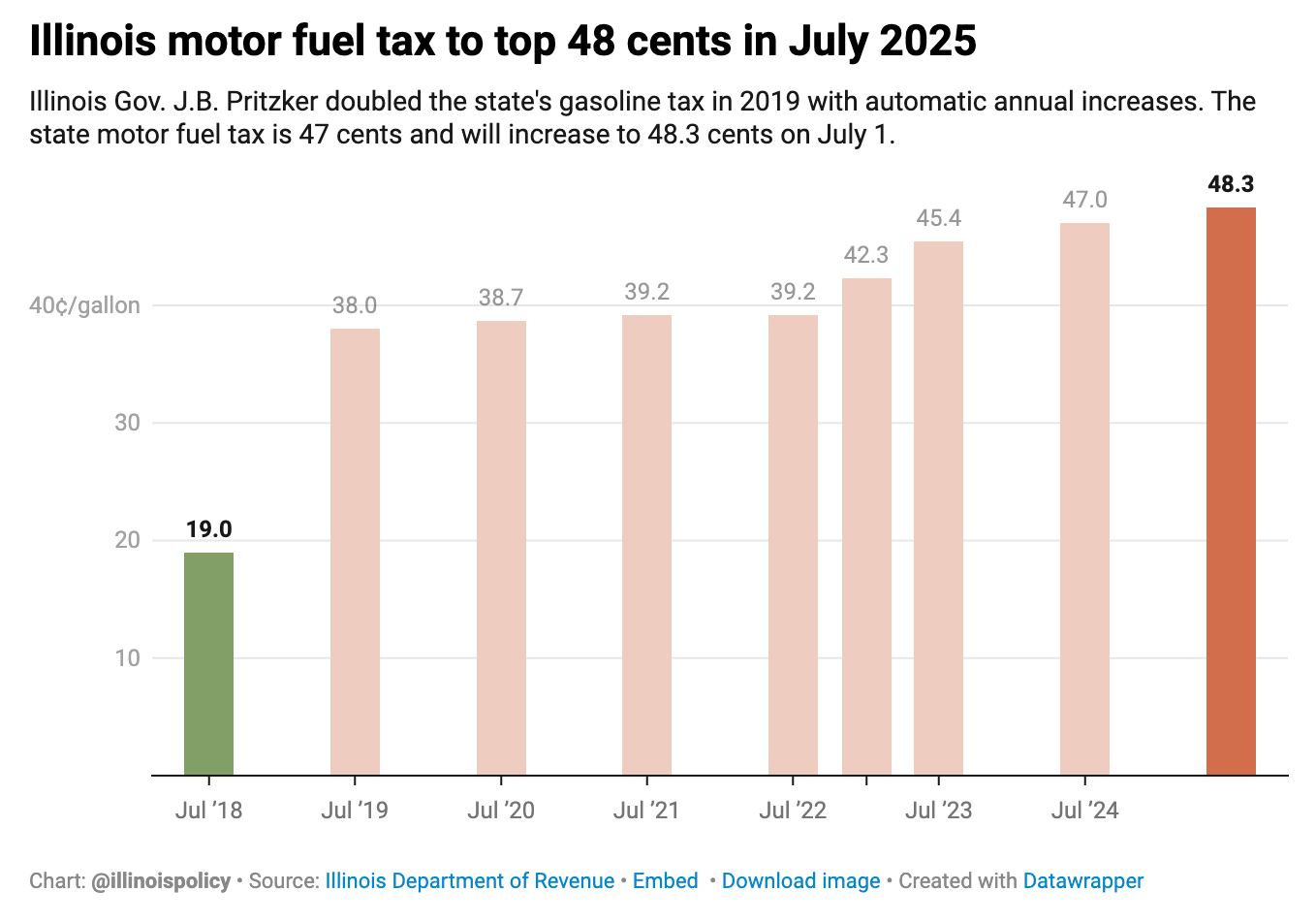

Illinois now taxes the license plates on electric vehicles to off-set the losses in the gasoline tax. And yet Pritzker still wants more. Under Pritzker, the state will again raise the gasoline tax, this time to a record 48 cents per gallon beginning on July 1.

For some politicians ill-equipped to lead, their only answer to problems is to tax the taxpayers. Instead of coming up with answers, they scream “Raise the Taxes.”

In six years, nothing has changed for hardworking Illinois residents except the steadily rising taxes that erode their paychecks and hard-earned salaries.

Illinois generally ranks in the lower half when compared to the other 49 states. While Illinois enjoys certain benefits like having a state with much “family fun” — that existed before Pritzker came to office, and a median family income that was earned by the hard work of the citizens of Illinois, the state lags in many other areas that are directly influenced by the governors office, like economic competitiveness, fiscal stability, and social mobility.

In other words, Illinois has done well for itself on its own. But when it comes to those areas that a governor can exert huge influence and change, Illinois lags far behind the other 49 states. And that failure rests on Pritzker’s shoulders and on his running mate, Juliana Stratton.

Here is an analysis of how badly Illinois has done under Pritzker:

Let’s look at how Pritzker has relied on burdening motorists to generate revenues. The biggest hikes in the gasoline tax, for example, have come under Pritzker. Every year. Here’s a chart of the hikes from the Illinois Policy Institute.

Here is an overview of Illinois’ tax burden and public services. How does Illinois Rank?

Illinois’ Tax Burden in National Perspective

Illinois residents bear one of the heaviest state-local tax burdens in the country. In 2025, Illinois’ total tax burden was about 10.2% of total personal income, the 7th highest among U.S. states wallethub.com. This “tax burden” reflects the share of income residents pay in state and local taxes (property, income, sales/excise). Key components of Illinois’ tax burden include:

Property Taxes: Illinois’ property tax burden is about 3.8% of income (8th highest in the U.S.) wallethub.com. The statewide effective property tax rate averages ~1.95% of a home’s value, which is more than double the national average and ranks 2nd highest nationally states.aarp.orgstates.aarp.org. In dollar terms, the median Illinois homeowner paid around $5,000 in property taxes (one of the highest in the nation).

Income Taxes: Illinois has a flat 4.95% state individual income tax rate taxfoundation.org. The income tax burden comes out to roughly 2.6% of income for the average Illinoisan, which is middle-of-the-pack (ranked 24th among states) wallethub.com. Notably, Illinois exempts retirement income from taxation, which benefits seniors.

Sales and Excise Taxes: The state sales tax rate is 6.25%, but after adding local sales taxes the average combined rate is ~8.85% states.aarp.org. Illinoisans pay about 3.8% of their income in sales and excise taxes on average (ranked 18th) wallethub.com. Certain excise taxes in Illinois are also high (for example, the state’s gas tax is around 66¢/gallon and cigarette tax $2.98/pack taxfoundation.org).

Overall, both WalletHub and the Tax Foundation confirm Illinois as a high-tax state. WalletHub’s analysis shows Illinois’ total tax burden (10.2% of income) is well above the U.S. average wallethub.com. Similarly, the Tax Foundation estimates Illinoisans pay roughly 12.9% of state income in state/local taxes, with only a handful of states (like New York, Connecticut, New Jersey, etc.) having a heavier load chicago.suntimes.comfiles.taxfoundation.org. In short, Illinois’ tax burden consistently ranks in the top 10 nationwide, driven largely by very high property taxes (and relatively high sales taxes), even though its flat income tax is comparatively moderatee chicago.suntimes.com.

Quality of Public Services in Illinois

Illinois’ public services present a mixed picture – excelling in some areas while lagging in others. According to U.S. News & World Report’s 2023 “Best States” analysis, Illinois ranked 36th overall in outcomes for residents patch.com. However, the state shines in a few key service categories:

Education: Illinois performs well in education. It ranked #12 nationally in education (K-12 and higher ed) in the 2023 U.S. News state rankings patch.com. Illinois has relatively strong K-12 public schools by many metrics. (In fact, Illinois was noted as 6th in the nation for K-12 education quality in one analysis gov.illinois.gov.) High school graduation rates and test scores in many Illinois districts exceed national averages, reflecting that residents do see strong education outcomes for their tax dollars.

Public Safety (Crime & Corrections): Despite Chicago’s well-known crime challenges, Illinois as a whole scores surprisingly well on public safety measures. U.S. News ranked Illinois #12 in “Crime & Corrections” (a category assessing public safety and the corrections system) patch.com. This suggests that outside of a few high-crime areas, Illinois’ crime rates and law enforcement efforts are better than many states. (By comparison, numerous states in the South and West rank much worse in violent and property crime rates.) Illinois’ prison/corrections system performance also contributed to this favorable ranking patch.com.

Infrastructure: Illinois is above average in infrastructure, ranking #19 for infrastructure in the U.S. News evaluation patch.com. The state benefits from robust transportation networks – it is a national rail and trucking hub, hosts one of the world’s busiest airports (O’Hare), and has extensive highway and transit systems. Many roads and bridges need maintenance (as in most states), but overall infrastructure quality and access (e.g. broadband access, public transit availability) in Illinois is strong relative to many states patch.com.

Healthcare: Illinois’ healthcare outcomes are around the national average. U.S. News ranked Illinois’ health care system 28th among statespatch.com. The state has some excellent hospital systems and medical centers (especially in Chicago), and its insured rate and health metrics are middling. For example, Illinois residents have roughly average rates of chronic illness and access to care. There is room for improvement in public health and affordability of care, as Illinois lands in the middle of the pack.

On other dimensions, Illinois struggles. For instance, Illinois ranked 39th in economic metrics (economy, business environment, job growth) patch.com and 35th in “Opportunity” (which covers cost of living, income equality, etc.) patch.com. The state’s Fiscal Stability was dead last (50th out of 50) patch.com – indicating serious budgetary issues (high pension debt, past budget deficits) that can undermine long-term service funding. Illinois also ranked below average on natural environment (#38) patch.com, reflecting pollution and environmental quality challenges around its urban/industrial areas.

Other analyses echo this mixed performance in services. WalletHub’s data on government services (which looked at education, health, safety, economy, infrastructure) ranked Illinois 19th in overall service quality wallethub.comwallethub.com. Notably, WalletHub rated Illinois’ Education system 8th best in the nation wallethub.com, but Safety 24th and Infrastructure & pollution 35th wallethub.com. In summary, Illinois does provide above-average education and infrastructure, and its public safety and health services are about average, but the state’s weaker economy and fiscal health drag down its overall public service rankings.

Taxpayer ROI and Fiscal Efficiency

A key question is whether Illinoisans receive good value for their taxes – in other words, does the quality of public services justify the high tax burden? Several studies have tried to measure this “taxpayer return on investment (ROI).” These analyses compare how much people pay in taxes versus the performance of government services. Illinois tends to rank poorly on taxpayer ROI – suggesting residents are not getting a great bang for their buck.

The Illinois State Capitol in Springfield. Illinois has high taxes but only middling government performance, leading to below-average taxpayer ROI. A WalletHub study in 2023 ranked Illinois just 36th out of 50 states for taxpayer ROI turnto10.comturnto10.com. In that analysis, Illinois had the 11th highest taxes per capita but only ranked 21st in overall government services – a mismatch between what taxpayers pay and what they receive turnto10.comturnto10.com. This poor ROI was “weighed down by [Illinois’] relatively high burden for property and sales taxes,” according to the Chicago Sun-Times chicago.suntimes.comchicago.suntimes.com. In other words, Illinois’ hefty tax collections aren’t translating into top-tier outcomes. By comparison, most neighboring states deliver better value – e.g. Missouri, Iowa, Wisconsin, and Kentucky all ranked among the top 15 states for taxpayer ROI, far ahead of Illinoischicago.suntimes.com.

Illinois’ efficiency in use of public funds is hampered by fiscal problems. The state has accumulated large pension and debt obligations – over $13,000 in state/local debt per capita, and only about 51% funding of its pension liabilities taxfoundation.org. U.S. News also rated Illinois 50th in fiscal stability (worst in the nation) patch.com. This implies that a significant portion of tax revenue is consumed by legacy costs (debt service, pension payments) rather than current public services. High taxes in Illinois have often been needed just to balance budgets and pay down obligations, not necessarily to boost service quality. This fiscal inefficiency contributes to the low taxpayer ROI – Illinois taxpayers pay a lot, but much of it plugs budget holes. As WalletHub’s experts noted, “States with higher tax burdens do not necessarily provide better government services…that’s not always the case, as we see in states like [Illinois]”turnto10.com.

So, do Illinois residents get good value for their taxes? Overall, Illinois is above average in what it spends and about average in what it delivers. The state’s tax burden is roughly 30-40% higher than the national median, yet its public service outcomes are mostly average or slightly above average. High-performing areas like education and infrastructure show that tax dollars can translate into good services in Illinois. However, the state’s middling healthcare, public safety (on some metrics), and poor fiscal health drag down the overall value proposition. In quantitative rankings of “taxpayer ROI,” Illinois falls in the bottom third of states turnto10.com, indicating residents are not getting a stellar return compared to many other states. In short, Illinoisans pay a premium in taxes and receive moderate-quality services – not the worst deal in the country, but certainly below the national average for taxpayer valuechicago.suntimes.com. Experts suggest Illinois will need to improve the efficiency of public spending (for example, addressing pension costs and budget management) if it wants to provide better outcomes commensurate with its high taxeschicago.suntimes.comchicago.suntimes.com.

That sure doesn’t sound like a strong campaign platform for Juliana Stratton to use as the foundation for her campaign for U.S. Senator to succeed Dick Durbin.

Stratton has not served in a national capacity and Durbin is involved in many national committees. God help us. We need a seasoned veteran.

Question: Is there any person in Illinois government that you do like?