Orland Park has lost millions in TIF property taxes and will lose more under Pekau's plans

TIFs have and will siphon millions of dollars in property taxes away from homeowners in Orland Park, TIF expert Tom Tresser warned at a meeting this week. Orland has already lost more than $47 million

By Ray Hanania

FREE/Orland Park TIFs Property Taxes/Saturday, Nov. 2, 2024

Orland Park residents were shocked to learn at a special Town Hall meeting Wednesday, Oct. 30, 2024 that the existing Main Street Triangle TIF has siphoned more than $47 million in property taxes and borrowing that would normally have been spent on essential community services.

The $47 million in lost property taxes from the TIF occurred during the past four years under Orland Park Mayor Keith Pekau. That’s reflected in his latest financial audit he was forced to release by the State Comptroller Susana Mendoza, which shows the village debt has jumped from $44 million to $66 million. And that’s only in the 2022 Audit. What does the 2023 Audit show? We don’t know and wouldn’t have known until Pekau was forced to file the audits by the State. But you can bet that Pekau will continue to delay the 2023 audit until after the election. He is probably hoping to use the TIFs to somehow cover his growing belief that no one would find out in time for the election in April 2025.

How bad is it all? At the special meeting held at Georgios Quality Inn, TIF expert Thomas Tresser disclosed that three new TIFs planned by Mayor Keith Pekau will redirect tens of millions more away from government services including local schools, village services, police, fire and the library among others.

Clearly that means more debt.

The disclosures on Orland Park TIFs -- Tax Increment Financing created to help blighted communities -- came as a result of research Tresser conducted on the limited public documents that are available. Pekau and Orland Park have delayed and denied requests under the Freedom of Information Act (FOIA) for information.

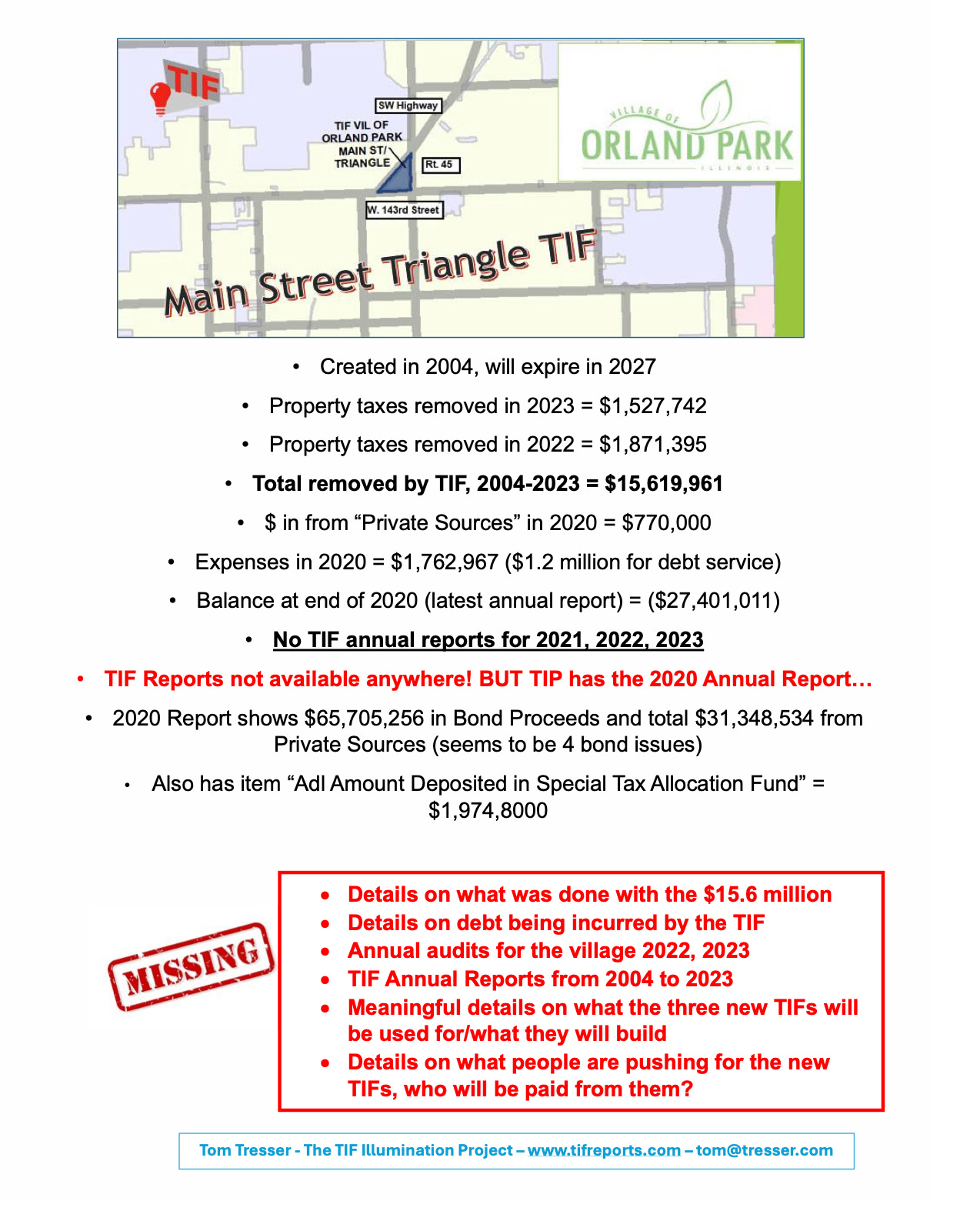

Not only has the Village of Orland Park failed to file two annual financial audits required by law for 2022 and 2023, Tresser said the village has also failed to file the required TIF financial audits for 2021, 2022 and 2023.

Financial audits explain how governments spend taxpayer money and identify debt that must be paid by increased property taxes and fees.

Tresser explained TIFs take taxes from businesses and homeowners and puts them in special funds controlled by the mayor. Instead of using that money to cover taxpayer needs, such as for schools, fire or police, they are used to help private developers. Those developers in turn make donations to the mayor's re-election.

The biggest losers in TIF developments are schools, like District 135 and District 230, which receives 67 percent of property taxes.

Instead of going to schools and other government services, Tresser said they are given to developers forcing schools and local governments to increase property taxes to cover costs.

The costs of a typical District 230 student is about $20,000 a year. In one TIF district planned by Pekau for the former Andrew Corporation property on 153rd Street, between 500 and 600 new homes are planned for new families and new students for the local schools. Instead of receiving property taxes from the new homes -- because they would go to the TIF -- schools would be forced to hike property taxes.

Tresser said public data from the Cook County Assessor shows eliminating TIFs would reduce community property taxes an average of 15 percent.

Although the Village of Orland Park failed to provide data, Tresser explained the Triangle TIF removed $15.6 million in property taxes from public services and schools and resulted in a $27.4 million unaccounted for "debt" or negative balance. Tresser said that negative balance is "unheard of" in TIFs he studied.

The Triangle TIF has redirected $1.87 million in 2022 and $1.5 million in 2023 from property tax services, such as schools, police, and fire.

TIFs are intended to help bring development and commerce to “Blighted” areas of a community, not to communities like Orland Park which is a middle and upper income community of more than 58,000 residents.

The Town Hall meeting was organized by Mohammed Jaber, a longtime education expert. Jaber serves as a trustee on school District 230's board but stressed he is speaking about the TIFs as a homeowner, taxpayer and father of several school children.

In introducing Tresser, Jaber said, "I'm a proud resident of Orland Park for over 16-years and I'm a special education teacher for 15 years teaching students who have learning struggles. I continue to advocate for the rights not only of our students, but also of our homeowners."

Jaber noted he was shocked to learn the Village failed to file annual audits for 2022 and 2023, and now is even more concerned the village has failed to file TIF reports for 2021 through 2023.

"I felt like this was the only way to educate homeowners and taxpayers on the impact this may have on Orland Park financially," Jaber said noting more public officials should be addressing the village's financial problems.

"Today's meeting is to help homeowners and taxpayers in Orland Park to understand what a TIF is and how it's used. TIF districts are not designed for a village like Orland Park. It was designed to help struggling communities and I believe Orland Park is not a struggling community. I will continue to stand up for the rights of the taxpayers in Orland Park."

The meeting was paid for by individual donations and was open to the public.

Here are videos of the meeting. Part 1 is the presentation. Part 2 is the Q&A

For more information visit Facebook.com/TIFsTaxesOrlandPark

Click here to view the PDF PowerPoint presentation.

VIDEO PART 1, Tom Tresser Presentation to Orland Park residents

Georgios Quality Inn Convention Center

PART 2, Tom Tresser Q&A with Orland Park Audience

Georgios Quality Inn Convention Center

It was a great night for democracy in Orland Park. It was my 246th public meeting. We hope to continue to Illuminate the past and future of TIFs there! Check out www.tifreports.com for more information on the TIF Illumination Project! tom@tresser.com