Bernie Madoff would be jealous of the US Congress

Members of Congress continue to beat the performance of the stockl market average at an extraordinary rate, according to a study released this week by UnusualWhales.com

By Ray Hanania

FREE/Stock Market Politicians Bernie Madoff/Tuesday Jan. 7, 2025

The term “too good to be true” became the theme of the prosecution of Bernie Madoff, the former NASDAQ Chairman who was later convicted for managing the largest investment Ponzi schemes in American history, more than $64 billion in securities fraud.

Greed prevented those who invested in Madoff’s “investment hedge fund” and clearly discouraged them from questioning his “miracle” practices. Surely, they didn’t want to lose out on the steady profits they received that continually beat out even the best investors who were losing money.

No one complained when they were getting their checks each month, profiting on the belief that Madoff knew how to invest better than the rest of the market.

The Securities and Exchange Commission (SEC), which was responsible for protecting investors, was too busy looking out for itself and they ignored the one man who saw the Madoff Ponzi scheme years earlier, Harry M. Markopolos, who was great at numbers but not so great at explaining anything to anyone else.

When someone is making a lot of money, they are hesitant to question how they profited and end the profit miracle gravy-train.

Of course, when it turned out their investments were actually scams — many people got the equivalent of their investments back from their dividends that were being paid out over the years of the scam — they didn’t blame themselves for allowing their own greed to close their eyes to the obvious red flags.

They became “victims” and they blamed it all on Bernie Madoff. The investors demanded that they be made whole by the SEC and the government, and many were. Taxpayers who weren’t rich enough to know Madoiff or invest in his fund were forced to help cover those losses.

The year 2024 was a good year for the stock market, and for investors who had money to put into the market. The stock market profit averaged 25 percent, slightly down from the 26 percent annual average the year before. (Click to view more years.)

A company called “Unusual Whales,” which provides stock market data, has released a fascinating look at how members of the U.S. Congress have out-averaged the stock market’s tremendous return performance, and you have to wonder if something is not fueling that profiteering on their part.

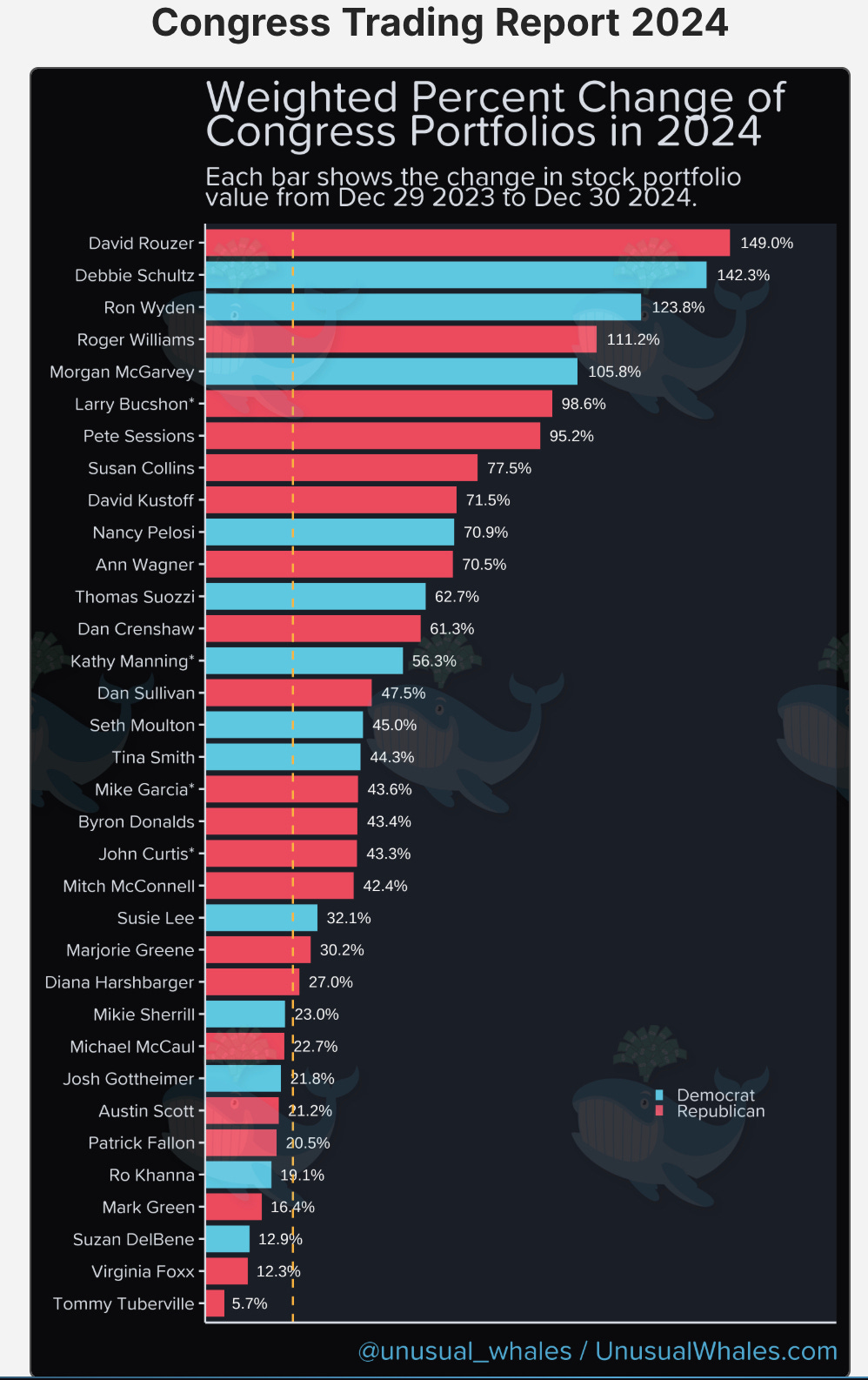

Take a look at the charts released by Unusual Whale which show how well some of the most powerful members of Congress did last year.

Either they had a lot of time on their hands to spend managing their millions in investments — instead of focusing on the needs of their constituents and voters — or they were just plain lucky. It all almost sounds “too good to be true,” and yet it is, apparently according to the numbers.

Overall, many Democrat and Republican members of Congress beat the market, again.

Many more profited although they didn’t reach the market average. It looks like very few members of Congress lost money, although some poor schumchs did, probably the ones who were busy responding to constituent needs rather than their own.

Here are a few charts that Unusual Whale published. (You can subscribe to their data by going to their website by clicking here.) The vertical yellow-dashed line represents the market profit average (showing who was above and who was below).

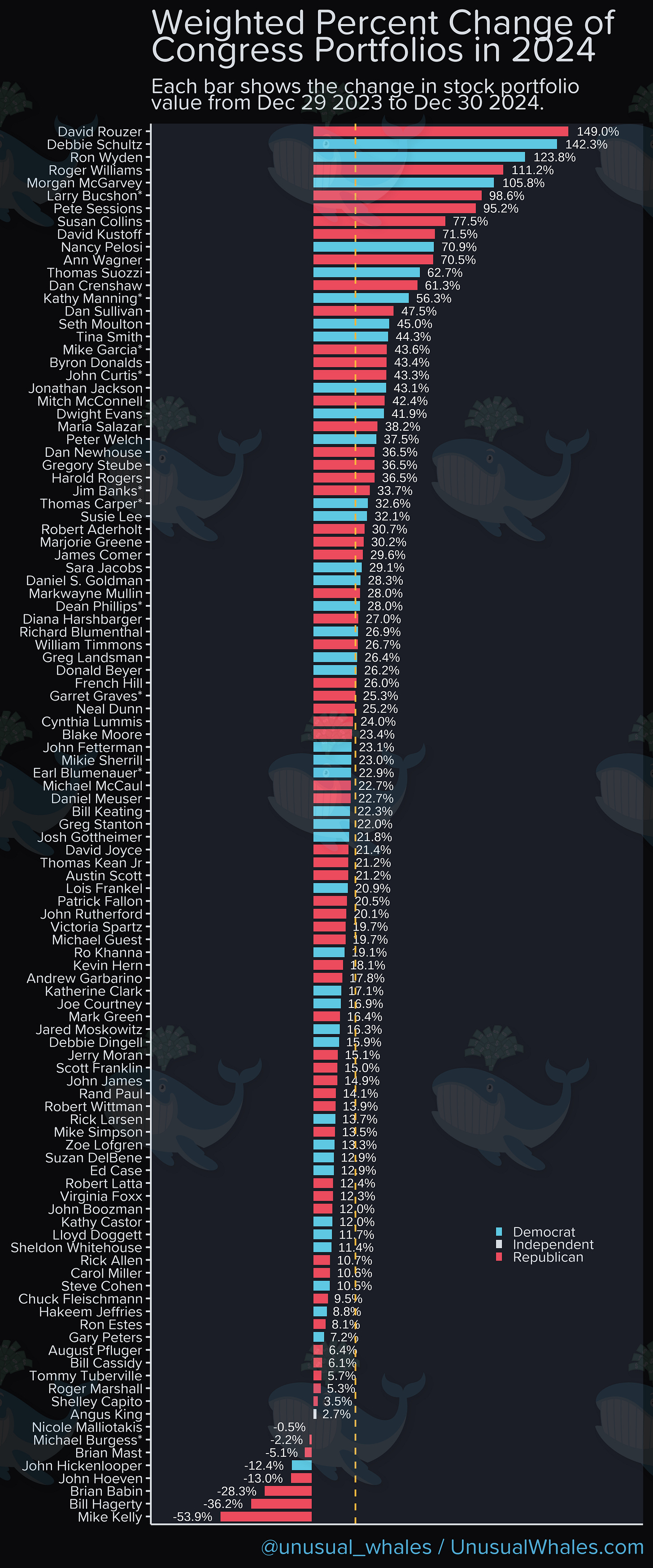

Here is another showing a wider range of Congressional investment.

There has been a call to prevent members of Congress from investing in the Stock Market because of obvious concerns about insider knowledge and their clout.

In its analysis and report, Unusual Whale writes:

“Many argue that lawmakers—with access to insider knowledge about upcoming policies—shouldn’t be allowed to buy or sell stocks.

“What does Congress have to say? Well, Texas Representative Dan Crenshaw, has been a vocal advocate for allowing members to trade stocks, saying: ‘Ya don't let us trade stocks. Don't let us make any money either.... we haven't gotten a pay raise since 2008.’

“He famously implied that without trading: ‘You have no way to better yourself’ as a member of Congress.

“Our major report in January 2023 prompted a bipartisan push to ban stock trading for Congress, but legislation stalled in both the House and Senate, despite there being numerous bills and bipartisan support. Other developments happened too: for the first time, we have been sponsored with a group to help bring two of the portfolios here to life. You can download our sponsor’s app, Autopilot, here to grab the top portfolios mentioned in this report, as well as other political portfolios like Nancy Pelosi.

“Now fast forward to 2024 and 2025, and Congress still hasn’t implemented a stock trading ban. Instead, the public relies on financial disclosures to hold lawmakers accountable. Most of the time, fines are not implemented and no change is made.”

I don’t trust Crenshaw. He is one of the most radical and extreme members of Congress who uses his military service and personal physical sacrifice as a shield to deflect criticism.

The “Stock Act” was passed a decade ago to prevent members of Congress from using their special ties and influence to engage in '“insider trading.” Clearly, the Act has not done its job.

It seems that when you win office, you also win the profit lottery, with more and more politicians quickly seeing their profits rise once they enter public office.

Ballotpedia, which monitors elections across the country, did an eye-opening analysis of the finances of members of Congress in 2014 that should be updated. They wrote then:

“For the first time in history, the majority of America's elected officials in Washington, D.C. are millionaires. At the same time, 50 percent of Americans cannot afford to spend $5,000 in an emergency.”

Little has changed in the past decade. Members of Congress tend to profit tremendously pandering to public emotions more than addressing public needs.

Members of Congress should be limited from investing in the stock market because of the obvious conflicts that arise from their political power and connections. At least they should be required to provide far more disclosure on any contacts they have with the companies they invest in or people who are engaged in the markets.

Don’t expect much to change. The agency responsible for making change is Congress itself and as we have seen over the years, they love to complain about everyone else except for themselves.

Congress is no better than the SEC. Fortunately, though, UnusualWhale.com is watching.

Any Illinois Congress Critters on the list?